Simplify your business registration with SureTax Bizcare –

your trusted partner for seamless Registration, Compliance, and Management.

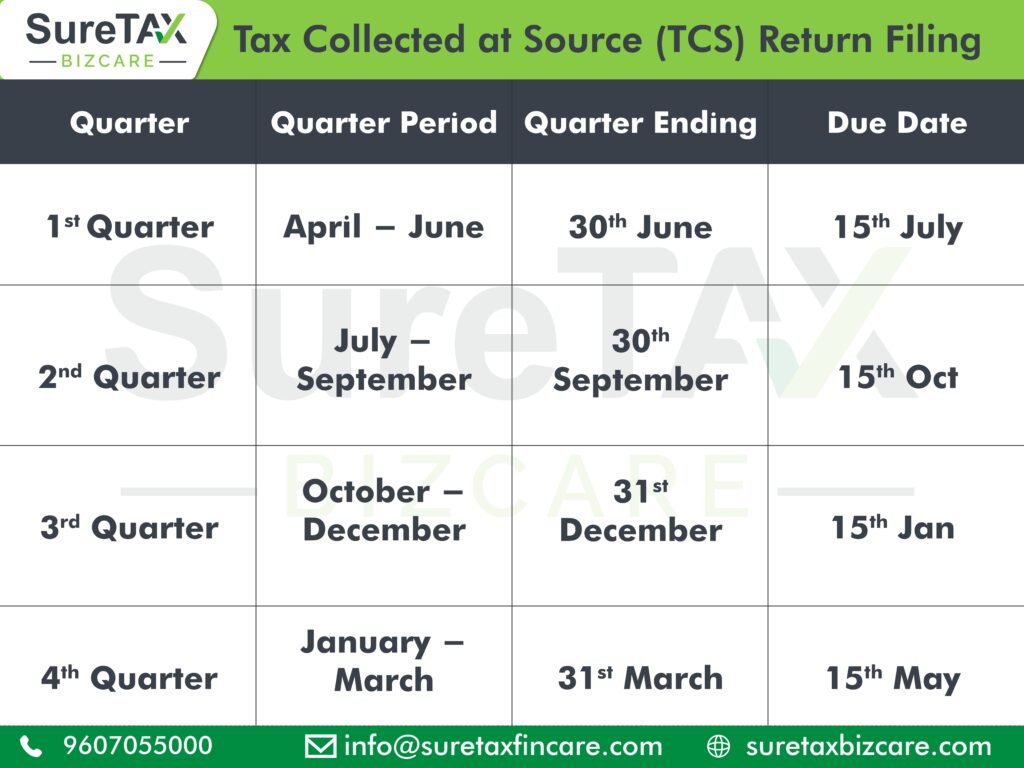

SureTax Bizcare streamlines the entire Tax Collected at Source (TCS) Return Filing process, making it easier and more convenient than ever before. Let us be your trusted Virtual Professional Partner—start today by completing this simple online form.

Experience a fully digital, fast, and hassle-free service accessible from anywhere in India or abroad.

Our team of Chartered Accountant-certified experts will guide you at every step, ensuring accuracy and compliance throughout the process.

Suretax provides expert business and financial consulting services, ensuring strategic growth and success for our clients.

© SureTax Bizcare.

Copyright © 2025 All rights reserved.